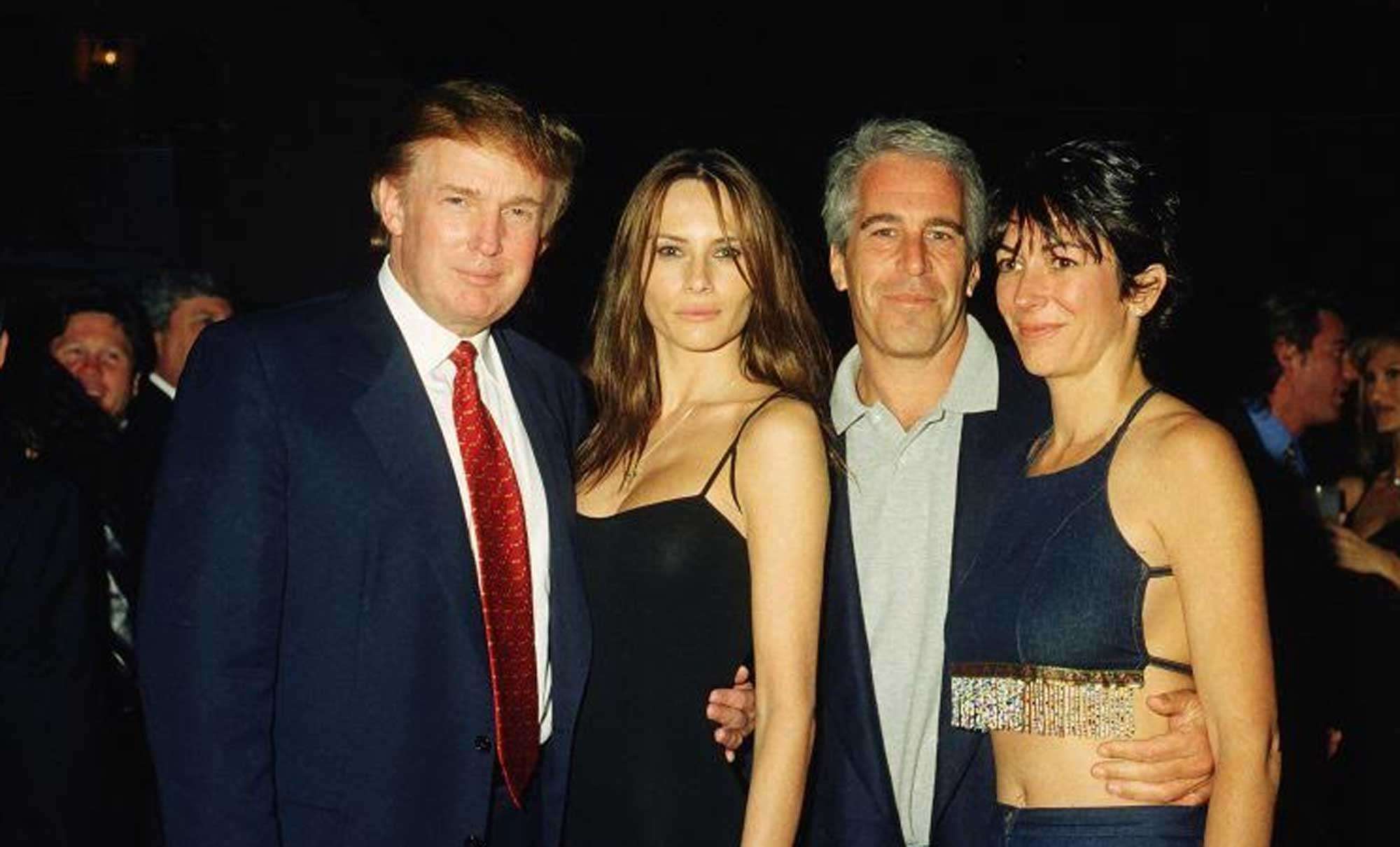

In a striking rebuke to executive authority and a major defeat for an economically pivotal policy of the Trump era, the U.S. Supreme Court on February 20th 2026, struck down broad global tariffs imposed by President Donald J. Trump, declaring they exceeded presidential powers under existing law. The 6-3 decision rejected the administration’s claim that the International Emergency Economic Powers Act (IEEPA) authorized sweeping import taxes, significantly eroding the legal foundation of one of Trump’s signature economic strategies. The ruling, delivered by Chief Justice John Roberts, marked an extraordinary moment in modern constitutional jurisprudence, directly challenging the reach of executive authority in shaping national economic policy and reaffirming that tariff powers reside with Congress.

A Legal Strike Down of IEEPA-Based Tariffs

At issue was the administration’s use of the International Emergency Economic Powers Act, a Cold War–era statute originally intended to give presidents broad authority to tackle overseas threats through economic sanctions. In 2025, the Trump administration declared various “national emergencies” tied to perceived threats from drug trafficking, persistent trade deficits and alleged unfair trade practices, and used IEEPA to justify tariff rates as high as 25% on imports from Canada and Mexico and 10% or more on goods from China and many other trading partners. In Learning Resources, Inc. v. Trump, the Supreme Court held that while IEEPA allows the executive branch to restrict or regulate imports in a national emergency, its language does not extend to imposing duties or taxes on imports, a power uniquely assigned by the Constitution to Congress. As the Court explained: the words “regulate … importation” in the statute cannot be stretched to grant tariff-setting authority. The decision was grounded in long-standing constitutional principles. Article I, Section 8 of the U.S. Constitution empowers Congress, not the president, to “lay and collect Taxes, Duties, Imposts, and Excises.” The Court reaffirmed this division of powers, holding that the president cannot, under IEEPA, unilaterally impose broad tariffs, no matter how urgent the perceived threat.

Political and Judicial Battlegrounds

The 6–3 vote split along both ideological and pragmatic lines, with the majority comprising a mix of liberal and conservative justices. The ruling notably included votes by some justices whom Trump himself appointed, underscoring the judiciary’s independence and its wariness of expansive executive power. In dissent, Justices Brett Kavanaugh and Clarence Thomas argued that presidents have historically imposed tariffs as part of regulating imports, and that IEEPA’s language and history supported the administration’s actions. They cautioned that severely limiting executive flexibility could have unintended consequences for U.S. economic responses in turbulent global markets. President Trump reacted angrily, denouncing the Court’s judgment as “anti-American” and a “disgrace to our nation’s economic security.” He specifically criticized two of his own appointees who joined the majority, accusing them of undermining his trade agenda at a critical moment.

Economic Fallout: Refunds, Markets, and Uncertainty

The ruling has immediate and far-reaching implications for businesses, consumers, and governments. By declaring the IEEPA tariffs invalid ab initio, meaning they were unlawful from the moment imposed, the Court effectively nullified billions of dollars in duties collected since their implementation. Importers, manufacturers and even small businesses are now preparing to pursue massive tariff refunds, potentially running into tens or even hundreds of billions of dollars. While the Supreme Court’s decision did not directly spell out refund procedures, legal experts expect the U.S. Court of International Trade to play a central role in adjudicating claims and directing how duties already paid should be returned. Export-oriented companies, particularly those in Europe, Asia and Latin America, welcomed the ruling as a relief from what critics had termed “economic protectionism of unprecedented scope.” U.S. manufacturers and supply chain managers also cautiously embraced a reduction in tariff overheads, though many acknowledge lingering uncertainty about the future of U.S. trade policy.

Trump’s Response: New Tariffs and a Continuing Trade War

Refusing to concede ground, Trump moved almost immediately to enact a new tariff strategy. Within a day of the Court’s decision, he announced that the United States would impose a 15% global tariff on all imports under a different legal authority Section 122 of the Trade Act of 1974 which permits temporary duties without congressional approval for a limited period. This move underscores Trump’s determination to press ahead with protectionist policies and reflects a broader strategy to keep economic pressure on foreign competitors even as legal constraints mount. However, legal analysts caution that this alternative authority is narrow, typically limited to 150 days, and could itself face future court challenges or require legislative backing for any extension.

Constitutional Precedent and Future Trade Policy

Legal scholars describe the Supreme Court’s ruling as a reaffirmation of the constitutional separation of powers in economic policymaking. By rejecting the executive’s open-ended tariff authority under an emergency law, the Court underscored that major economic decisions with broad implications require clear congressional authorization. Despite this, the decision did not eliminate all avenues for presidential influence over trade. Numerous statutory regimes, such as those governing national security tariffs or remedies for unfair trade practices, still grant the executive branch considerable discretionary power, provided actions align with specific congressional objectives. The ruling also highlights the continued influence of the “major questions doctrine,” a legal framework that requires explicit congressional authorization for executive actions with profound economic and political impact. By applying this doctrine, the Court signalled that sweeping policies cannot be shoe-horned into ambiguous statutory language simply because of the scope of the issue.

Political Repercussions and the Broader Debate

Beyond legal and economic realms, the tariff battle has deepened political fault lines within the United States. Trump’s supporters argue that tariffs are essential tools for protecting domestic industries and countering unfair trade practices. Critics, including many economists, counter that broad tariffs raise costs for American consumers and businesses that rely on global supply chains, while potentially triggering retaliatory actions by trade partners.

Some Republican lawmakers expressed frustration with the ruling and with the Supreme Court’s decision to curtail what they see as vital presidential flexibility in responding to global market imbalances. Conversely, many Democrats hailed the judgment as a key victory for constitutional governance and fiscal accountability. Internationally, the decision is likely to shape global trade negotiations and alliances. Foreign leaders have cautiously welcomed the Court’s assertion of legal limits on executive tariff power, viewing it as a stabilizing factor amid persistent uncertainties around U.S. trade policy. Yet with new tariffs looming, the global economic community remains vigilant.

A Turning Point in Trade and Constitutional Law

The Supreme Court’s decision in Learning Resources, Inc. v. Trump represents a historic moment at the crossroads of constitutional law, economic policy and geopolitics. By invalidating the broad tariff regime that defined much of the Trump administration’s trade strategy, the Court not only checks executive overreach but also re-energizes the debate over how the United States engages with the global economy. As the government, businesses and lawmakers grapple with the ramifications, from refunds to replacement tariff schemes to international reactions, this episode will likely shape American trade policy and executive-legislative relations for years to come.