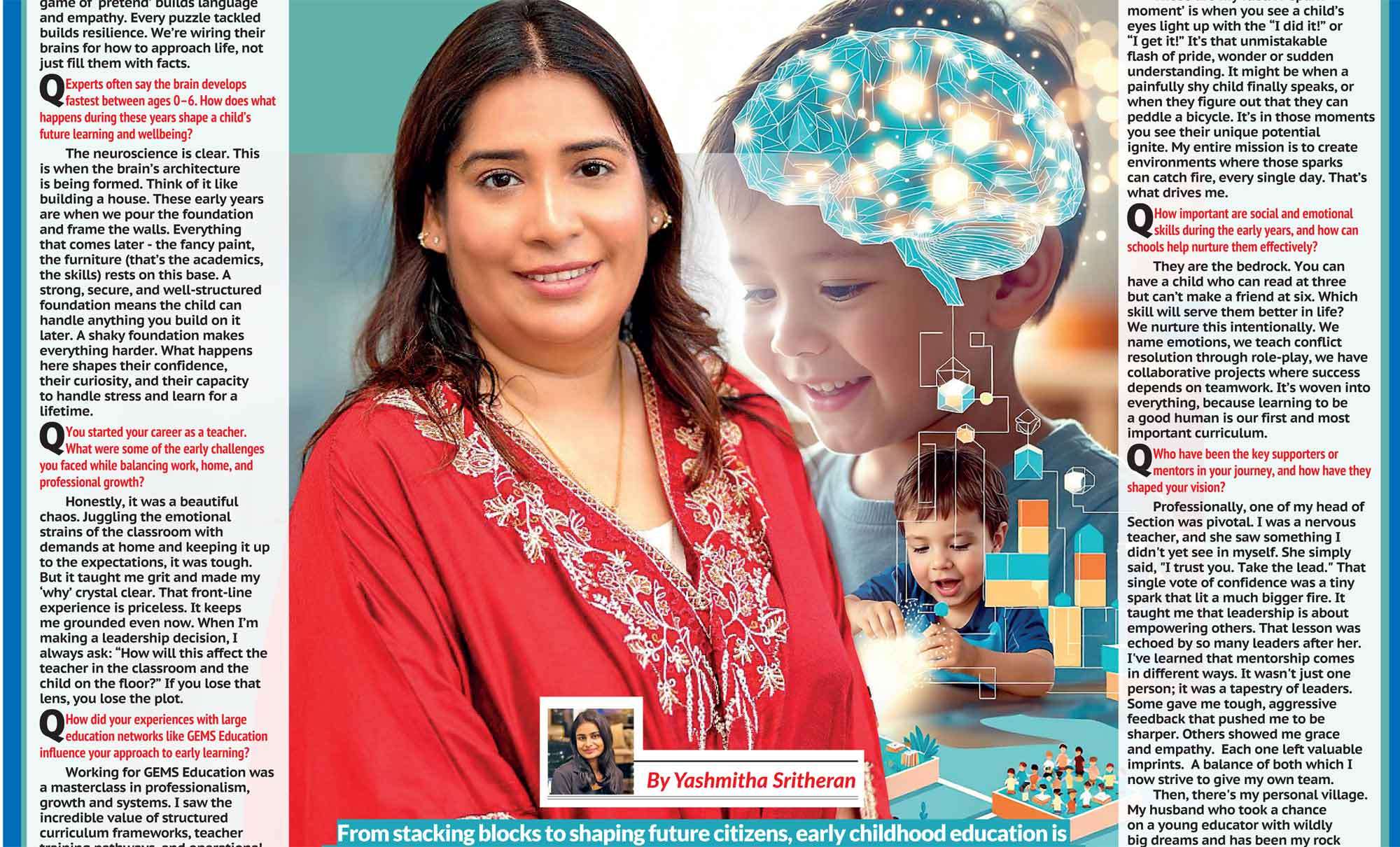

By Dr. Sulochana Segera

In an era where banking is rapidly transforming through technology, innovation, and a renewed focus on customer experience, few professionals embody this evolution as wholly as Niroshini Rathnasinghe. With a 24-year journey at People’s Bank, she has seamlessly transitioned from frontline operations to retail banking, IT administration, product innovation, and now, credit leadership. Today, she leads the Regional Credit Unit at the Gampaha Regional Head Office, navigating complex financial decisions with empathy, insight, and resilience. A Chartered Marketer, MBA holder, and mentor, Niroshini’s career is a masterclass in adaptability and purpose. She speaks to us about her unlikely start in banking, the values that shaped her trajectory, and the responsibility she feels to empower the next generation; especially women. In this candid conversation, Niroshini opens up about professional reinvention, building inclusive workplaces, and the power of living one’s truth as both a leader and a mother.

Q Why did you choose to be a banker? Was this a childhood dream or a decision that evolved with time?

I didn’t grow up dreaming of becoming a banker. As a child, I aspired to become a medical doctor. However, I’ve always been a people person. I wanted to work in a space where empowerment and inspiration were mutual, where I could grow while helping others grow. Life has a beautiful way of guiding us to our purpose. When I joined People’s Bank at the age of 19, I immediately felt a strong connection with the meaningful impact we make in people’s lives. Over time, I fell in love with the purpose-driven nature of banking, the ability to empower individuals, businesses, and communities through financial solutions. It became more than a job; it became my mission.

Q From retail banking and branch operations to IT administration and now as Manager of the Regional Credit Unit, your 24-year journey at People’s Bank spans multiple disciplines. What core values or habits have helped you navigate such diverse roles successfully?

The values that have guided me through every stage of my career are a deep acceptance of challenges, a thirst for knowledge, unwavering integrity, and resilience. I’ve always been eager to gain new experiences, to understand how systems work, how people think, and how we can do things better. That mindset kept me learning and evolving across disciplines, be it in retail banking, operations, IT, or credit. Integrity has anchored every decision, especially in roles of responsibility. Resilience helped me embrace change, adapt quickly, and grow from every challenge. Most importantly, I approach each day with the mindset of “one day at a time” and aim to make the best of it.

Q Your early career began at the front line as a Staff Assistant. How did that hands-on branch experience shape the way you designed products and channels during your time in retail banking?

Starting at the front line taught me to deeply understand the core needs of the customer. I didn’t just complete transactions, I heard life stories, dreams, and struggles. That shaped my perspective forever. Every product or service I worked on after that came from a place of empathy. I designed not from behind a desk, but from the vantage point of the customer experience. I focused on simplicity, emotional resonance, and accessibility. Customer behaviour has changed with technology and generational expectations. That front-line exposure helped me connect the dots during product development, ensuring our solutions evolved to serve multiple customer segments effectively. It became the foundation for how I build experiences that truly resonate.

Q “YES” Youth Savings won a SLIM Nielsen Brand Excellence Award in 2017. What unmet youth insight led to the product concept, and what were the toughest hurdles getting it from idea to launch?

“YES” Youth Savings was born from a powerful insight: young people don’t want just another savings account. They seek identity, purpose, and belonging. We realized youth needed a financial product that felt like a brand made for them, aspirational, yet relevant. The biggest challenge was creating alignment across all departments, marketing, IT, compliance, legal, and operations. Everyone had to be on board with a unified vision. Once that internal synergy was built, the next challenge was to take the concept national, engaging branches and staff across the island with one common purpose. Winning the SLIM Nielsen Award was a proud milestone, but the real success was watching the youth emotionally connect with the product and begin their financial journey with pride.

Q You’re both an MBA and a Chartered Marketer. How does the marketer’s mindset influence your decisions in IT and operations, functions often considered ‘back-office’ and your present responsibility in Credit?

Being a marketer at heart has shaped how I approach even the most technical or back-end functions. Marketing teaches you to see beyond processes and look at people. So, whether I’m involved in IT, operations, or credit, I always ask: Does this process make life easier for our customers or staff? Is it intuitive? Is it creating value? In IT and operations, I don’t view workflows in isolation, I see the end-to-end user journey. In my current credit role, that mindset becomes even more important. Credit isn’t just about numbers; it’s about people, livelihoods, and future potential. My marketing background helps me assess risk with empathy, see the story behind the paperwork, and shape credit strategies rooted in both data and human insight. Ultimately, I believe back-end excellence fuels front-end impact. When we view internal systems through the lens of human value, we create transformation.

Q Having earned qualifications in psychology and career guidance, how do you use those skills to mentor younger bankers and foster cross-functional collaboration?

Psychology has helped me understand people at a deeper level, their motivations, fears, and strengths. Across my roles, I’ve had the opportunity to mentor many, from Business Promotions Officers to IT Graduate Trainees. I don’t just advise; I help them discover their values, build confidence, and unlock their potential. These skills also enhance how I work across teams. In cross-functional settings, I act as a bridge, mediating, building trust, and creating environments where ideas can thrive. Emotional intelligence isn’t just a soft skill; it’s a leadership strength. When we understand each other better, we work together better.

Q What is your view about careers for women in the banking sector? Have you seen a shift in attitudes or opportunities during your career?

When I started, leadership roles for women were limited, not just by external bias, but also by internal reluctance. Many women held back for personal reasons or because of societal expectations. But I believe leadership isn’t defined by gender; it’s defined by impact. That said, certain innate traits in women can uniquely enrich leadership. Today, I’ve seen a remarkable shift. Women are thriving in areas like operations, credit, compliance, and technology. Yet, the journey toward equality continues. It’s not just about giving women space; it’s about empowering them with tools, support, and mentorship to lead unapologetically and authentically.

Q Diversity in leadership remains a challenge in finance. What practical steps should banks take to empower more women to reach senior roles?

We need intentional, structured pathways. Banks should design leadership pipelines specifically for women, supported by mentoring, coaching, and sponsorship. Maternity policies and flexible work models must be enabling, not limiting. Just as importantly, we must foster inclusive workplace cultures that challenge unconscious bias and promote meritocracy. When women see others like them in leadership, they begin to believe they can rise too. Representation is powerful. It’s not a buzzword; it’s a blueprint.

QAs a single mother who has built a remarkable career in banking, what personal strengths or support systems helped you balance ambition with motherhood, and what message would you give to other women walking a similar path?

Balancing motherhood and a career is one of life’s most delicate acts. It demands clarity, discipline, and above all, purpose. For me, my son was my strength, my reason to rise, not pause. My late mother believed in me and supported me wholeheartedly. I was also blessed with mentors, friends, and bosses who encouraged my dreams. To women walking a similar path: don’t wait for perfect conditions. Start where you are. Be both strong and soft. Nurture your ambition and your family. Your story matters, and it will light the way for others.

Q What is your advice to young people who want to join the banking sector today? What skills, mindset, or attitudes do they need to succeed?

The future of banking belongs to those who can blend empathy with agility. My advice? Be a lifelong learner. Understand evolving technologies but never lose the human touch. Build strong communication skills, ethics, and emotional intelligence. Stay humble, stay curious, and see every challenge as an opportunity to grow. The best bankers of tomorrow will solve problems, create value, and lead with heart.

RAPID FIRE ROUND

Your dream job as a child? A medical doctor.

One word that defines your leadership style? Empowering.

Tea or coffee during a long workday? Coffee, it energizes and keeps me centred.

Morning meetings or evening brainstorms? Morning meetings. I believe in starting strong.

Your go-to stress buster? Listening to soft music.

The most used app on your phone? Instagram.

Best advice you’ve ever received? “Progress over perfection. Keep moving.”

Your personal mantra for tough days? “This too shall pass.”

Who inspires you the most? My son, his resilience and dreams give me purpose.

A book that changed your perspective? Atomic Habits by James Clear, it taught me that small changes lead to big results.