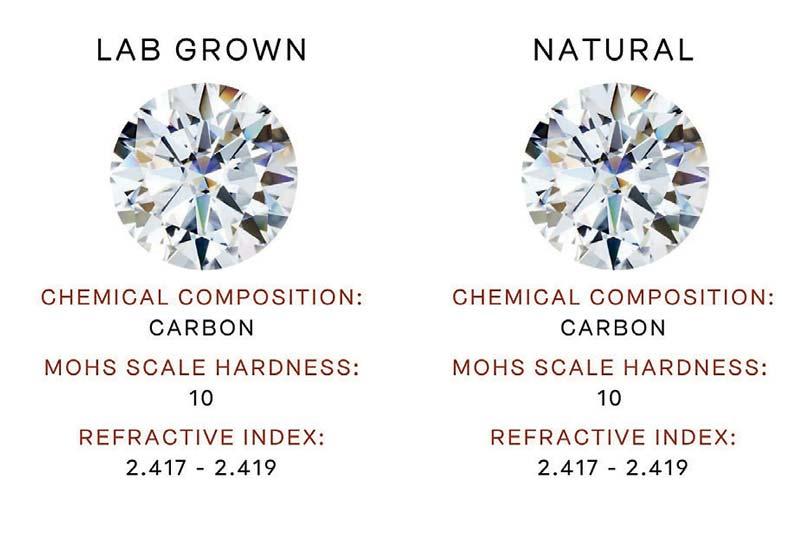

Unlike diamond simulants such as cubic zirconia or moissanite, lab-grown diamonds are “real” diamonds. They can be certified and graded by leading gemmological organizations like the Gemmological Institute of America (GIA) and the International Gemmological Institute (IGI)

Once considered a niche innovation, lab-grown diamonds are now a disruptive force in the global diamond industry. These gems, chemically identical to their mined counterparts, have sparked both enthusiasm and controversy, offering consumers a sustainable, ethical, and often more affordable alternative to traditional diamonds. As consumer values evolve and technology advances, lab-grown diamonds are not merely a trend, they’re fundamentally reshaping the diamond industry and retail landscape.

What Are Lab-Grown Diamonds?

Lab-grown diamonds, also known as synthetic or cultured diamonds, are created in controlled laboratory environments using two primary methods: High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). Both processes mimic the natural conditions under which diamonds form in the earth, resulting in stones that are optically, physically, and chemically identical to mined diamonds. Unlike diamond simulants such as cubic zirconia or moissanite, lab-grown diamonds are “real” diamonds. They can be certified and graded by leading gemmological organizations like the Gemmological Institute of America (GIA) and the International Gemmological Institute (IGI).

Why Consumers Are Choosing Lab-Grown Diamonds

The appeal of lab-grown diamonds lies in several factors, with ethics and sustainability at the forefront. Traditional diamond mining is associated with environmental degradation, ethical concerns, and human rights issues, including the long-standing problem of “blood diamonds” or conflict diamonds. Lab-grown diamonds, on the other hand, avoid many of these issues. While they still require energy to produce, especially through HPHT methods, their overall environmental impact tends to be lower than that of mining. Innovations in renewable energy are helping further reduce the carbon footprint of lab diamond production. Affordability is another driving factor. Lab-grown diamonds typically cost 30% to 50% less than mined diamonds of similar quality. For millennials and Gen Z consumers, who prioritize sustainability and transparency while managing tighter budgets, this price difference can be decisive. Lastly, transparency and traceability are key. Unlike mined diamonds, which may pass through multiple hands before reaching the end consumer, lab-grown diamonds often have a clear and documented production chain. Retailers are leveraging this to build trust with increasingly conscientious buyers.

The Industry’s Mixed Response

The rise of lab-grown diamonds has elicited mixed reactions from traditional players. Major mining companies, once dismissive, are now entering the lab-grown space themselves. De Beers, historically synonymous with natural diamonds, launched its own lab-grown brand, Lightbox Jewellery, in 2018, focusing on fashion-oriented and price-transparent offerings. Yet, many luxury houses and high-end jewellers remain committed to mined diamonds, viewing them as more prestigious and inherently valuable. Brands like Tiffany & Co. have expressed reluctance to embrace lab-grown diamonds for engagement rings, arguing that mined diamonds carry emotional and historical significance that lab-grown alternatives cannot replicate.

Meanwhile, retailers like Pandora have pivoted towards lab-grown diamonds as part of their sustainability initiatives. In 2021, Pandora announced it would stop using mined diamonds entirely, underlining the shifting priorities within mainstream retail.

Shifting Retail Strategies

The diamond retail space is undergoing a transformation as sellers adapt to consumer preferences. E-commerce platforms specializing in lab-grown diamonds have proliferated, capitalizing on digital-savvy consumers. Online retailers like Brilliant Earth, Clean Origin, and VRAI emphasize ethical sourcing, environmental responsibility, and competitive pricing, appealing particularly to millennial and Gen Z buyers. Traditional brick-and-mortar jewellers are also incorporating lab-grown collections to diversify their offerings and remain competitive. Retailers are finding that carrying both mined and lab-grown options allows them to cater to broader market segments, from luxury buyers to value-conscious shoppers. However, the integration is not without challenges. Sales staff need to be trained to educate customers effectively, avoiding misconceptions about lab-grown diamonds being “fake” or inferior. Transparency in marketing is critical to maintain consumer trust and avoid accusations of greenwashing.

Economic Implications for the Diamond Industry

Lab-grown diamonds are disrupting the supply-demand balance in the diamond industry. The increased availability of high-quality lab-grown stones has led to a more price-competitive environment. Prices for both lab-grown and natural diamonds have faced downward pressure as consumers perceive them as interchangeable, especially for non-investment purchases like fashion jewellery. For diamond mining companies, this trend is concerning. Reports from industry analysts suggest that lab-grown diamonds could command up to 20% of the global diamond jewellery market within the next decade. Mining-dependent economies, especially in Africa, may experience economic strain if demand for mined diamonds continues to decline. Moreover, lab-grown diamonds introduce scalability that mined diamonds cannot match. Production can ramp up rapidly in response to demand, further destabilizing traditional pricing models based on rarity and controlled supply.

The Investment Debate

A critical distinction between mined and lab-grown diamonds is their perceived value as investments. Historically, natural diamonds, especially those with high carat weights and exceptional qualities, have retained or appreciated in value. Lab-grown diamonds, however, depreciate more sharply after purchase, owing to their scalability and the steady improvements in production technology. For consumers buying diamonds primarily for their symbolism or beauty, this may be a minor concern. But for those considering diamonds as long-term investments, mined diamonds still hold the edge.

The Future of Lab-Grown Diamonds

Looking ahead, lab-grown diamonds are poised to become a mainstream option rather than a niche choice. As consumer awareness grows and production costs continue to decrease, lab-grown diamonds could capture an even larger share of the market.

Technology is also pushing innovation. Some manufacturers are experimenting with coloured lab-grown diamonds and unique cuts that are less viable with natural stones, offering consumers greater customization and creativity. Simultaneously, sustainability claims in lab-grown production are coming under scrutiny. Environmental groups emphasize the need for third-party verification of carbon neutrality claims, urging manufacturers to adopt renewable energy and transparent reporting practices.

Conclusion

Lab-grown diamonds represent both a challenge and an opportunity for the global diamond industry. They answer the growing consumer demand for ethical and sustainable products while delivering high-quality, visually identical alternatives at lower prices. For retailers, lab-grown diamonds open new avenues for growth but necessitate transparent communication and education to manage consumer expectations. As technology, consumer preferences, and industry dynamics continue to evolve, the diamond industry faces a defining moment. Lab-grown diamonds may not replace mined diamonds entirely, but they are reshaping the narrative of what a diamond can be, and what it should represent in the modern age.